Getting Started

Introduction

Simplifying Buying

Kredivo checkout API allows you to implement our checkout process so Kredivo users can make a transaction on your platform, be it web based or app based. Our checkout API now comes in many variations, each one suitable for a specific need. Each variation differs by the parameters that you will be required to pass, but is the same API at its core. The checkout API can be broken down into the following use cases: 2-click checkout, 0-click checkout, QR checkout, and personal loan transaction. 1. 2-click checkout: User will need to enter his/her Kredivo phone number & PIN, followed by an OTP, to do a transaction 2. 0-click checkout: This feature allows a user to tokenize his/her Kredivo account on your platform. Once tokenized, any subsequent transaction can be done without having the user enter his/her Kredivo credentials (in some cases, OTP might still be required) 3. QR checkout: Our solution for offline transaction. Available in 2 flavors: dynamic (unique per transaction ID) or static (unique per store/merchant) 4. Personal loan transaction: Lets you offer Kredivo personal loan service

| Optimized for all devices | More sales with no risk |

|---|---|

| Kredivo Checkout adapts seamlessly to both desktops and mobile devices. This means that you instantly get the same conversion on mobiles as on desktops. One-click buying increases conversion by an additional 29% for returning customers. | Kredivo assumes all risk for both the customer and merchant. That means no more charge-backs for you as a merchant. |

Try Kredivo Checkout

We have set up a demo checkout so that you can try it out yourself, just go to one of our partner sites.

Preparation

Prepare your site

To complete the Kredivo Checkout integration process as simply and quickly as possible, we recommend that you start by setting up the following.

Checkout page and confirmation page

Both the checkout page and the checkout confirmation page are hosted by you. Both these pages must include a div that you will populate with the Kredivo Checkout button. You will learn what the Kredivo Checkout is in our first tutorial, embed the checkout. Kredivo Checkout is responsive, which means that it will always use the full width of the container.

Tip! Place the Kredivo Checkout button so that your customers can see it instantly after loading the checkout page without scrolling. Provide clear calls to action to improve your conversion rates, such as “Finalize your purchase now”.

An example of what the checkout looks like on different devices.

Push notification URI

As you will learn in the Confirm purchase tutorial, Kredivo needs a URI to inform you of the order status. You will need to include a placeholder in the push URI, which Kredivo will then replace with the order URI when we send the push request. You can download example push URI Here

Developer Help

If you need any help with the documentation and sandbox environment, please email merchops@finaccel.co and we will respond as soon as possible.

If you do not have a merchant account, please email merchops@finaccel.co to get setup with one.

Developer FAQ

- Does Kredivo work on desktop and mobile? Yes, desktop, mobile, and tablet web.

- I am not a retailer but I want to offer Kredivo financial products in my site/app do you have an API for that? See previous answer. If you are interested in using Kredivo for your site/app, email us at merchops@finaccel.co

- Is Kredivo another payment processor? No. Kredivo is a point of sale credit solution for your customers.

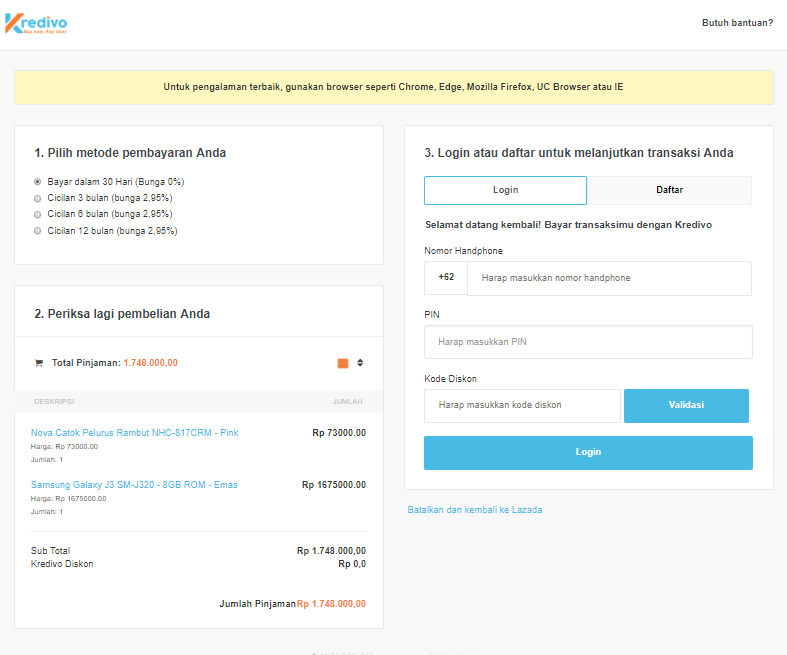

2-click Checkout

This is the most basic checkout feature suitable for either a web based platform or app based platform. Here is the API structure:

First, you will need to call the checkout API by passing all the required parameters. If successful, you will receive a redirect URL as a response. This URL will redirect the user to Kredivo payment page. There are at least 3 components that are required to obtain the payment page:

- server_key

You will need a server_key to interact with the Kredivo server. Please send an email to merchops@finaccel.co to sign up as an Kredivo merchant and get the server_key.

- Order Id

- Transaction Amount

Initiate 2-click Checkout

To initiate 2-click checkout with Kredivo, you will need to call checkout_url API.

Using the API:

The Request JSON structured like this:

{

"server_key":"MEJ4FLRc74UU64cxCF8Z3HYSpPctD7",

"payment_type":"30_days",

"client_user_key": "rangge@finaccel.co",

"transaction_details": {

"amount":6505000,

"order_id":"KD14721",

"items": [

{

"id":"BB12345678",

"name":"iPhone 5S",

"price":6000000,

"type":"Smartphone",

"url":"http://merchant.com/cellphones/iphone5s_64g",

"quantity":1

},

{

"id":"AZ14565678",

"name":"Hailee Sneakers Blink Silver",

"price":250000,

"url":"http://merchant.com/fashion/shoes/sneakers-blink-shoes",

"type":"Sneakers",

"quantity":2,

"parent_type":"SELLER",

"parent_id":"SELLER456"

},

{

"id":"taxfee",

"name":"Tax Fee",

"price":1000,

"quantity":1

},

{

"id":"shippingfee",

"name":"Shipping Fee",

"price":9000,

"quantity":1,

"parent_type":"SELLER",

"parent_id":"SELLER456"

},

{

"id":"discount",

"name":"Discount",

"price":5000,

"quantity":1

}

]

},

"sellers":[

{

"id":"SELLER123",

"name":"Sunrise",

"email": "sunrise@gmail.com",

"url":"https://onlineshop/seller/sunrise",

"address" : {

"first_name":"Irfan",

"last_name":"Sutandro",

"address":"Jalan Tentara Pelajar no 49",

"city":"Jakarta Utara",

"postal_code":"12960",

"phone":"08123456789",

"country_code":"IDN"

}

},

{

"id":"SELLER456",

"name":"Toko Bagus",

"email": "tokobagus@gmail.com",

"url":"https://onlineshop/seller/tokobagus",

"address" : {

"first_name":"Toto",

"last_name":"Wahyuni",

"address":"Jalan Krinci raya IX no 1",

"city":"Jakarta Selatan",

"postal_code":"12960",

"phone":"08123456789",

"country_code":"IDN"

}

}

],

"customer_details": {

"first_name":"Oemang",

"last_name":"Tandra",

"email":"alie@satuduatiga.com",

"phone":"081513114262"

},

"billing_address": {

"first_name":"Oemang",

"last_name":"Tandra",

"address":"Jalan Teknologi Indonesia No. 25",

"city":"Jakarta",

"postal_code":"12960",

"phone":"081513114262",

"country_code":"IDN"

},

"shipping_address": {

"first_name":"Oemang",

"last_name":"Tandra",

"address":"Jalan Teknologi Indonesia No. 25",

"city":"Jakarta",

"postal_code":"12960",

"phone":"081513114262",

"country_code":"IDN"

},

"metadata": {

"ip_address":"192.168.88.1",

"user_agent":"Mozilla/5.0 (Windows NT 6.1; Win64; x64; rv:47.0) Gecko/20100101 Firefox/47.0"

},

"push_uri":"https://api.merchant.com/push",

"back_to_store_uri":"https://merchant.com"

}

The Response returns JSON structured like this:

Positive Response :

{

"status":"OK",

"message":"Message if any",

"redirect_url":"https://sandbox.kredivo.com/kredivo/v2/signin?tk=XXX"

}

Negative Response:

{

"status": "ERROR",

"error": {

"message": "Field secret_key is INCORRECT.",

"kind": "APIException"

}

}

and

{

"error": {

"kind": "deprecated",

"message": "This order is already PROCESSED.",

"code": null

},

"status": "ERROR"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| payment_type | String | Required. You can set default value with 30_days or 12_months. Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| client_user_key | String | Optional. Required if tokenize_user = true. Should be unique per user on client side |

| transaction_details | Transaction | Details of the transaction |

| customer_details | Customer | Required. Details of the customer |

| sellers | Seller | Optional (compulsory for marketplaces). Details of the seller for marketplaces |

| billing_address | Address | Optional. Billing address of the customer/shopper |

| shipping_address | Address | Required. Shipping address of the customer/shopper. shipping is required for goods (excluding ticket/voucher). |

| metadata | Metadata | Optional. Object containing the metadata parameters. |

| push_uri | String | Required. URI of merchant push-notification API (HTTP POST). |

| user_cancel_uri | String | Optional. URI that the customer is sent to if the customer chooses to cancel the Kredivo payment before completion. |

| back_to_store_uri | String | Required. URI of your store page. Used on the settlement page. Kredivo’s server will pass some params to this uri for merchant’s server acknowledgement: order_id: Order Id given by Merchant; tr_id: Transaction Id given by Kredivo;tr_status: Transaction status of a transaction; sign_key: Signature key to validate if the notification is originated from Kredivo. |

| expiration_time | String (epoch) | Optional. By default, kredivo will expire the transaction in 24 hours. |

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| message | String | Description of status |

| redirect_url | String | Redirect URL will be sent for regular transaction. If the user has been authenticated, there will be 2 scenarios: If our security system flags the transaction, we will pass a redirect URL that contains an OTP challenge for the user. Otherwise, we will not pass any redirect URL and you will only need to wait for a callback from Kredivo. |

| error | Message : Description of error status; Kind : error type |

Transaction

| Name | Type | Description |

|---|---|---|

| order_id | String | Required. Order Id given by merchant |

| amount | Double | Required. The transaction amount |

| items | Item | Required. The shopping items |

Product Item

| Name | Type | Description |

|---|---|---|

| id | String | Required. Can be product SKU. Important! for item fee such as: shipping fee, admin fee etc. you have to use this id: shippingfee, adminfee, taxfee, discount, additionalfee, insurancefee, mixpayment. |

| name | String | Required. product name given by merchant |

| price | Double | Required. Price of the item. |

| url | String | Required. URL to the product item on merchant site. |

| image_url | String | Optional. URL to the product item image. |

| type | String | Required. Product category. |

| quantity | Integer | Required. Quantity of the item bought. |

| parent_type | String | Optional. You can assign the fee to either SELLER or ITEM. If not specified, this will be tied to transaction level. |

| parent_id | String | Optional. This is either the seller Id or item Id |

Customer

| Name | Type | Description |

|---|---|---|

| first_name | String | Required. |

| last_name | String | Optional. |

| String | Required. | |

| phone | String | Required. |

Address

| Name | Type | Description |

|---|---|---|

| first_name | String | Required. |

| last_name | String | Optional. |

| address | String | Required. |

| city | String | Required. |

| postal_code | String | Required. |

| phone | String | Required. |

| country_code | String | Required. ISO 3166-1 alpha-3 |

Seller

| Name | Type | Description |

|---|---|---|

| id | String | Required. Seller’s Id |

| name | String | Required. Seller’s name |

| url | String | Require. Seller’s url |

| legal_id | String | Optional. Seller’s legal Id (KTP, SIM or passport number) |

| String | Required. Seller’s email | |

| address | Address | Required. Seller’s residential address |

Metadata

| Name | Type | Description |

|---|---|---|

| ip_address | String | Optional. |

| user_agent | String | Optional. |

| device_id | String | Optional. IMEI or IMSI of buyer device |

| imsi | String | Optional. |

HTTP(S) Header

| Name | Type | Description |

|---|---|---|

| Content-Type | String | application/json |

| Accept | String | application/json |

Confirm Transaction

In this tutorial you will learn how to confirm that you have received and created an order in your system. This confirmation is needed in response to a push notification from Kredivo, indicating that the user has completed the transaction. Once you have received the push notification, you should update the status of the transaction.

1. Receive notification from Kredivo

Once a consumer has completed a purchase, Kredivo will inform you via a POST request. The POST request will be made to the push notification URI you provided when you created the checkout order.

HTTP Notification example of transaction::

{

"status": "OK",

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "pending",

"order_id": "KD125262",

"message": "Transaction status is pending",

"shipping_address": {

"city": "Jakarta Selatan",

"first_name": "Darana 2",

"last_name": "Pratama",

"countrycode": "IDN",

"creation_date": "2017-08-04T18:28:14",

"phone": "0217248724",

"state": "",

"transaction": 1505866,

"postcode": "12120",

"location_details": "Jl. Kerinci IX No. 5-A"

},

"transaction_time": 1501846094,

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8",

"signature_key": "o5KZPDcxgEA9QutAVcIQwE3suQRkTEIA1VXcoHp7KaWJnpHx0uuHETBVpxfYLbaPyS8RJg34uVxTUX64cfUTzVVhCrSif%2FUg92J2WyLs%2FhQ%3D"

}

Response Body from Kredivo

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| shipping_address | Address | Optional. Shipping address of the customer/shopper |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

Response Address Info

| Name | Type | Description |

|---|---|---|

| city | String | Optional. |

| first_name | String | Optional. |

| last_name | String | Optional. |

| countrycode | String | Optional. |

| creation_date | String | Optional. |

| phone | String | Optional. |

| state | String | Optional. |

| transaction | Integer | Optional. |

| postcode | String | Optional. |

| location_details | String | Optional. |

2. Merchant Response

merchant response should be in JSON, structured like this:

{

"status":"OK",

"message":"Message from merchant if any"

}

3. Confirm the order status

You must now get the order status to validate the notification originated from Kredivo server

Using the API:

GET /kredivo/v2/update?transaction_id=bb0380d7-2688-4e73-a668-997f3fc5cbec&signature_key=5f1fa4a524f5a8201a3a373d67b5796840bed1598b2bb816855d0e14d01cd09b988b4b861f39bed642b4db861108bbf0dd84ce8e17caf675d4bf2c81ab545397

Request Body

| Name | Type | Description |

|---|---|---|

| transaction_id | String | Transaction Id given by Kredivo |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

Response Body

Example response after call API v2/update:

{

"status": "OK",

"legal_name": "TANDRA",

"fraud_status": "accept",

"order_id": "KD125262",

"transaction_time": 1501846094,

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "settlement",

"message": "Confirmed order status. Valid!",

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8"

}

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR). |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| fraud_status | String | Detection result by Fraud Detection System (FDS), the values is:accept: Approved by FDS; deny: Denied by FDS. Transaction automatically failed |

| legal_name | String | legal name of kredivo account |

| user_token | String | Once the user authentication succeeds, we will send you the user token. Use this token to enable the express checkout for the user. Currently the user token has no expiration. |

4. Settle an order in your system

You should now settle the order in your system with the order data that you want to store if transaction_status is SETTLEMENT.

0-click Checkout

0-click Checkout is a feature that allows Kredivo users to tokenize their Kredivo account inside the merchant’s platform. A tokenized user will then be able enjoy our express checkout feature. Whereas our regular checkout requires the user to enter his/her phone number, PIN, and OTP to confirm the transaction, the 0-click Checkout will essentially allow the user to checkout without entering anything. In the case where our security system flags a transaction as suspicious, we will throw an OTP challenge to the user. Here is the API structure:

0-click Checkout is a great leap forward even when compared to our already smooth 2-click regular checkout. It is the smoothest checkout process in the market today, giving unparalleled user experience.

This feature is only available for select merchants. Contact us if you’re interested in using this feature.

Initiate 0-click Checkout

This step will show you how you can tokenize the user through our regular checkout page. If you are interested in tokenizing the user separately from the transaction, read the Tokenize Kredivo Account guide below.

The first time you call this API, you will need to pass the parameter tokenizer_user as true to enable tokenization. If that transaction is successful, you will get a user_token in our response. Any subsequent transaction will now become 0-click once you start passing this user_token.

To initiate 0-click Checkout with Kredivo, you will need to call checkout_url API.

Using the API:

The Request JSON structured like this:

{

"server_key":"MEJ4FLRc74UU64cxCF8Z3HYSpPctD7",

"payment_type":"30_days",

"tokenize_user": false,

"client_user_key": "rangge@finaccel.co",

"user_token" : "XXXX-XXXX",

"transaction_details": {

"amount":6505000,

"order_id":"KD14721",

"items": [

{

"id":"BB12345678",

"name":"iPhone 5S",

"price":6000000,

"type":"Smartphone",

"url":"http://merchant.com/cellphones/iphone5s_64g",

"quantity":1

},

{

"id":"AZ14565678",

"name":"Hailee Sneakers Blink Silver",

"price":250000,

"url":"http://merchant.com/fashion/shoes/sneakers-blink-shoes",

"type":"Sneakers",

"quantity":2,

"parent_type":"SELLER",

"parent_id":"SELLER456"

},

{

"id":"taxfee",

"name":"Tax Fee",

"price":1000,

"quantity":1

},

{

"id":"shippingfee",

"name":"Shipping Fee",

"price":9000,

"quantity":1,

"parent_type":"SELLER",

"parent_id":"SELLER456"

},

{

"id":"discount",

"name":"Discount",

"price":5000,

"quantity":1

}

]

},

"sellers":[

{

"id":"SELLER123",

"name":"Sunrise",

"email": "sunrise@gmail.com",

"url":"https://onlineshop/seller/sunrise",

"address" : {

"first_name":"Irfan",

"last_name":"Sutandro",

"address":"Jalan Tentara Pelajar no 49",

"city":"Jakarta Utara",

"postal_code":"12960",

"phone":"08123456789",

"country_code":"IDN"

}

},

{

"id":"SELLER456",

"name":"Toko Bagus",

"email": "tokobagus@gmail.com",

"url":"https://onlineshop/seller/tokobagus",

"address" : {

"first_name":"Toto",

"last_name":"Wahyuni",

"address":"Jalan Krici raya IX",

"city":"Jakarta Selatan",

"postal_code":"12960",

"phone":"08123456789",

"country_code":"IDN"

}

}

],

"customer_details": {

"first_name":"Oemang",

"last_name":"Tandra",

"email":"alie@satuduatiga.com",

"phone":"081513114262"

},

"billing_address": {

"first_name":"Oemang",

"last_name":"Tandra",

"address":"Jalan Teknologi Indonesia No. 25",

"city":"Jakarta",

"postal_code":"12960",

"phone":"081513114262",

"country_code":"IDN"

},

"shipping_address": {

"first_name":"Oemang",

"last_name":"Tandra",

"address":"Jalan Teknologi Indonesia No. 25",

"city":"Jakarta",

"postal_code":"12960",

"phone":"081513114262",

"country_code":"IDN"

},

"metadata": {

"ip_address":"192.168.88.1",

"user_agent":"Mozilla/5.0 (Windows NT 6.1; Win64; x64; rv:47.0) Gecko/20100101 Firefox/47.0"

},

"push_uri":"https://api.merchant.com/push",

"back_to_store_uri":"https://merchant.com"

}

The Response returns JSON structured like this:

Positive Response :

{

"status":"OK",

"message":"Message if any",

"redirect_url":"https://sandbox.kredivo.com/kredivo/v2/signin?tk=XXX"

}

Negative Response:

{

"status": "ERROR",

"error": {

"message": "Field secret_key is INCORRECT.",

"kind": "APIException"

}

}

and

{

"error": {

"kind": "deprecated",

"message": "This order is already PROCESSED.",

"code": null

},

"status": "ERROR"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| payment_type | String | Required. You can set default value with 30_days or 12_months. Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| tokenize_user | Boolean | Optional, default value is false. Set this to True if you want to tokenize the user. You will get user_token when the transaction status is settled. |

| client_user_key | String | Optional. Required if tokenize_user = true. Should be unique per user on client side |

| user_token | String | Optional. If user_token is set, this will be used to authenticate user. |

| transaction_details | Transaction | Details of the transaction |

| customer_details | Customer | Required. Details of the customer |

| sellers | Seller | Optional (compulsory for marketplaces). Details of the seller for marketplaces |

| billing_address | Address | Optional. Billing address of the customer/shopper |

| shipping_address | Address | Required. Shipping address of the customer/shopper. shipping is required for goods (excluding ticket/voucher) |

| metadata | Metadata | Optional. Object containing the metadata parameters |

| push_uri | String | Required. URI of merchant push-notification API (HTTP POST) |

| user_cancel_uri | String | Optional. URI that the customer is sent to if the customer chooses to cancel the Kredivo payment before completion |

| back_to_store_uri | String | Required. URI of your store page. Used on the settlement page. Kredivo’s server will pass some params to this uri for merchant’s server acknowledgement: order_id: Order Id given by Merchant; tr_id: Transaction Id given by Kredivo;tr_status: Transaction status of a transaction; sign_key: Signature key to validate if the notification is originated from Kredivo. |

| expiration_time | String (epoch) | Optional. by default kredivo set expiration time 24 hours after transaction time. |

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| message | String | Description of status |

| redirect_url | String | Redirect URL will be sent for regular transaction. If the user has been authenticated, there will be 2 scenarios: If our security system flags the transaction, we will pass a redirect URL that contains an OTP challenge for the user. Otherwise, we will not pass any redirect URL and you will only need to wait for a callback from Kredivo. |

| error | Message : Description of error status; Kind : error type |

Transaction

| Name | Type | Description |

|---|---|---|

| order_id | String | Required. Order Id given by merchant |

| amount | Double | Required. The transaction amount |

| items | Item | Required. The shopping items |

Product Item

| Name | Type | Description |

|---|---|---|

| id | String | Required. Can be product SKU. Important! for item fee such as: shipping fee, admin fee etc. you have to use this id: shippingfee, adminfee, taxfee, discount, additionalfee, insurancefee, mixpayment. |

| name | String | Required. product name given by merchant |

| price | Double | Required. Price of the item |

| url | String | Required. URL to the product item on merchant site |

| image_url | String | Optional. URL to the product item image |

| type | String | Required. Product category. |

| quantity | Integer | Required. Quantity of the item bought |

| parent_type | String | Optional. You can assign the fee to either SELLER or ITEM. If not specified, this will be tied to transaction level |

| parent_id | String | Optional. This is either the seller Id or item Id |

Customer

| Name | Type | Description |

|---|---|---|

| first_name | String | Required. |

| last_name | String | Optional. |

| String | Required. | |

| phone | String | Required. |

Address

| Name | Type | Description |

|---|---|---|

| first_name | String | Required. |

| last_name | String | Optional. |

| address | String | Required. |

| city | String | Required. |

| postal_code | String | Required. |

| phone | String | Required. |

| country_code | String | Required. ISO 3166-1 alpha-3 |

Seller

| Name | Type | Description |

|---|---|---|

| id | String | Required. Seller’s Id |

| name | String | Required. Seller’s name |

| url | String | Require. Seller’s url |

| legal_id | String | Optional. Seller’s legal Id (KTP, SIM or passport number) |

| String | Required. Seller’s email | |

| address | Address | Required. Seller’s residential address |

Metadata

| Name | Type | Description |

|---|---|---|

| ip_address | String | Required. |

| user_agent | String | Required. |

| device_id | String | Optional. IMEI or IMSI of buyer device |

| imsi | String | Optional. |

HTTP(S) Header

| Name | Type | Description |

|---|---|---|

| Content-Type | String | application/json |

| Accept | String | application/json |

Confirm Transaction

In this tutorial you will learn how to confirm that you have received and created an order in your system. This confirmation is needed in response to a push notification from Kredivo, indicating that the user has completed the transaction. Once you have received the push notification, you should update the status of the transaction.

1. Receive notification from Kredivo

Once a consumer has completed a purchase, Kredivo will inform you via a POST request. The POST request will be made to the push notification URI you provided when you created the checkout order.

HTTP Notification example of transaction::

{

"status": "OK",

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "pending",

"order_id": "KD125262",

"message": "Transaction status is pending",

"shipping_address": {

"city": "Jakarta Selatan",

"first_name": "Darana 2",

"last_name": "Pratama",

"countrycode": "IDN",

"creation_date": "2017-08-04T18:28:14",

"phone": "0217248724",

"state": "",

"transaction": 1505866,

"postcode": "12120",

"location_details": "Jl. Kerinci IX No. 5-A"

},

"transaction_time": 1501846094,

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8",

"signature_key": "o5KZPDcxgEA9QutAVcIQwE3suQRkTEIA1VXcoHp7KaWJnpHx0uuHETBVpxfYLbaPyS8RJg34uVxTUX64cfUTzVVhCrSif%2FUg92J2WyLs%2FhQ%3D"

}

Response Body from Kredivo

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| shipping_address | Address | Optional. Shipping address of the customer/shopper |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

Response Address Info

| Name | Type | Description |

|---|---|---|

| city | String | Optional. |

| first_name | String | Optional. |

| last_name | String | Optional. |

| countrycode | String | Optional. |

| creation_date | String | Optional. |

| phone | String | Optional. |

| state | String | Optional. |

| transaction | Integer | Optional. |

| postcode | String | Optional. |

| location_details | String | Optional. |

2. Merchant Response

merchant response should be in JSON, structured like this:

{

"status":"OK",

"message":"Message from merchant if any"

}

3. Confirm the order status

You must now get the order status to validate the notification originated from Kredivo server

Using the API:

GET /kredivo/v2/update?transaction_id=bb0380d7-2688-4e73-a668-997f3fc5cbec&signature_key=5f1fa4a524f5a8201a3a373d67b5796840bed1598b2bb816855d0e14d01cd09b988b4b861f39bed642b4db861108bbf0dd84ce8e17caf675d4bf2c81ab545397

Request Body

| Name | Type | Description |

|---|---|---|

| transaction_id | String | Transaction Id given by Kredivo |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

Response Body

Example response after call API v2/update:

{

"status": "OK",

"legal_name": "TANDRA",

"fraud_status": "accept",

"order_id": "KD125262",

"transaction_time": 1501846094,

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "settlement",

"message": "Confirmed order status. Valid!",

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8",

"user_token" : "XXXX-XXXX"

}

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR). |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| fraud_status | String | Detection result by Fraud Detection System (FDS), the values is:accept: Approved by FDS; deny: Denied by FDS. Transaction automatically failed |

| legal_name | String | legal name of kredivo account |

| user_token | String | Once the user authentication succeeds, we will send you the user token. Use this token to enable the express checkout for the user. Currently the user token has no expiration. |

4. Settle an order in your system

You should now settle the order in your system with the order data that you want to store if transaction_status is SETTLEMENT.

Deactivate User Token

This step you can allow user to deactive his tokenized

Using the API:

The Request JSON structured like this:

{

"server_key": "ABCD-XXXX-1234",

"user_token": "XXXX-YYYY"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | string | Mandatory |

| user_token | string | user_token sent from Kredivo to tokenize the user. |

Response

{

"Status": "OK",

"user_token": "XXXX-YYYY",

"is_active":false,

"remarks":"deactive user successful"

}

Negative response JSON should be structured like this:

{

"status": "ERROR",

"error": {

"code": null,

"message": "Invalid merchant",

"kind": "deprecated"

}

}

Or

{

"error": {

"kind": "deprecated",

"message": "Invalid user_token",

"code": null

},

"status": "ERROR"

}

Success Response

| Name | Type | Description |

|---|---|---|

| status | string | OK |

| user_token | string | user_token sent from Kredivo to tokenize the user. |

| is_active | boolean | True/False. If False, Kredivo is not able to provide User Credit Details. |

| remarks | string | remarks about user token |

Error Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code : ERROR |

| error | Object | detail of error detail |

Detail of Error

| Name | Type | Description |

|---|---|---|

| kind | String | type of error |

| code | Integer | error code |

| message | String | Error message |

Deactive From Kredivo App

The Request JSON structured like this:

{

"message": "message if any",

"client_user_key": "rangge@finaccel.co"

}

User can also deactivate his/her tokenized account from Kredivo app. Push notif will be sent to inform respective merchant to invalidate user_token. Please contact kredivo to register your push notif endpoint url.

The Response JSON structured like this:

{

"status": "OK",

"message": "message if any"

}

Please note when calling to POST /kredivo/v2/checkout_url with invalid token you will get redirect_url on response body that you should handle to continue as regular checkout (i.e. 2-click Checkout)

Get User Credit Details

Once the user is tokenized, you can then call this API to know about the remaining limit, account status, and account type of the user. You will need the user token to call this API.

Using the API:

The Request JSON structured like this:

{

"server_key": "ABCD-XXXX-1234",

"user_token": "XXXX-YYYY"

}

Request

| Name | Type | Description |

|---|---|---|

| server_key | string | Mandatory |

| user_token | string | Mandatory. user_token sent from Kredivo to tokenize the user. |

Response

{

"Status": "OK",

"user_details" : {

"legal_name" : "Rangge Septyo",

"mobile_number": "62812xxxx0581"

},

"user_credit_details": {

"account_status":1,

"account_type":2,

"credit_limit_details":[

{

"payment_type":"30_days",

"remaining_user_limit":"1500000"

}

{

"payment_type":"3_months",

"remaining_user_limit":"4500000"

}

{

"payment_type":"6_months",

"remaining_user_limit":"9000000"

}

{

"payment_type":"9_months",

"remaining_user_limit":"13500000"

}

{

"payment_type":"12_months",

"remaining_user_limit":"18000000"

}

{

"payment_type":"18_months",

"remaining_user_limit":"27000000"

}

{

"payment_type":"24_months",

"remaining_user_limit":"36000000"

}

]

}

}

Negative response JSON should be structured like this:

{

"status": "ERROR",

"error": {

"kind": "deprecated",

"message": "Invalid user_token",

"code": null

}

}

Success Response

| Name | Type | Description |

|---|---|---|

| status | string | status code : OK |

| user_details | object | detail of user . |

| user_credit_details | object | detail of user credit details |

User Details

| Name | Type | Description |

|---|---|---|

| legal_name | String | |

| mobile_number | String |

User Credit Details

| Name | Type | Description |

|---|---|---|

| account_status | integer | Possible values (1: active, 2. inactive) |

| account_type | integer | 1: basic (eligible for “30_days” and “3_months” payment type ONLY), 2: premium (eligible for “30_days”, “3_months”, “6_months”, “9_months”, “12_months”, “18_months”, “24_months” payment types) |

| credit_limit_details | obejct | list of credit_limit: credit limit details per payment type |

Credit Limit Details

| Name | Type | Description |

|---|---|---|

| payment_type | string | Possible values: “30_days”, “3_months”, “6_months”, “9_months”, “12_months”, “18_months”, “24_months” |

| remaining_user_limit | string | remaining user limit for payment type |

Error Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code : ERROR |

| error | Object | detail of error detail |

Detail of Error

| Name | Type | Description |

|---|---|---|

| kind | String | type of error |

| message | String | Error message |

QR Checkout

QR Checkout is our solution for those of you have have a physical store. Kredivo offers two kinds of QR code: dynamic and static.

A dynamic QR code is one that is generated every time you initiate a new transaction. This means, you must integrate Kredivo QR checkout API into your POS system. Contact us to find out more about how to integrate this API, either directly or via a POS provider.

A static QR code means the QR is always the same. This means the QR is generated for a store/merchant. Static QR does not require you to do any development from your side. The only difference in terms of user experience is that the user will have to manually enter the transaction amount in his/her Kredivo app when transacting using a static QR.

We also provide a seller app to help you monitor the transactions and perform cancellation.

Here is the API structure:

Contact us to know more about our QR solution.

Initiate QR Checkout

This guide will tell you how you can integrate our dynamic QR solution. To initiate QR checkout with Kredivo, you will need to call the init_checkout API.

Using the API:

The Request JSON structured like this:

{

"server_key":"8tLHIx8V0N6KtnSpS9Nbd6zROFFJH7x",

"amount":70000,

"source": "QR",

"qr_type": "IMAGE",

"order_id": "548tIt83saeN",

"sub_merchant_id": "KFCSenayanCity",

"push_uri" : "https://www.merchantcallback.com/notify",

"sellers":

{

"id":"SELLER123",

"name":"Sunrise",

"email": "sunrise@gmail.com",

"url":"https://onlineshop/seller/sunrise",

"address" : {

"first_name":"Irfan",

"last_name":"Sutandro",

"address":"Jalan Tentara Pelajar no 49",

"city":"Jakarta Utara",

"postal_code":"12960",

"phone":"08123456789",

"country_code":"IDN"

}

},

"items": [

{

"id": "001",

"name":"Product Name",

"price":50000,

"type":"Category Product",

"quantity":1

},

{

"id": "002",

"name":"Product Name",

"price":25000,

"type":"Category Product",

"quantity":1,

"additional_info":{

"imei":"1234281484285",

"color":"black"

}

},

{

"id":"discount",

"name":"Discount",

"price":5000,

"quantity":1

}

]

}

Response for QR Image:

{

"status": "OK",

"message": "",

"qr_image": "{HOST}/{endpoint}/v1/qrcode/{merchant_id}/{external_merchant_id}/6a643481-33fa-4fa7-9135-8a1503fc863a",

"qr_numeric_code": 114376,

"transaction_id": "6a643481-33fa-4fa7-9135-8a1503fc863a"

}

Response for QR String:

{

"status": "OK",

"message": "",

"qr_image": {

"type": "TRANSACTION",

"qr_id": "b1849e0d-22dd-4a7e-b848-2bb55c49fb64"

},

"qr_numeric_code": 114376,

"transaction_id": "6a643481-33fa-4fa7-9135-8a1503fc863a"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| amount | Double | Required. The transaction amount |

| source | String | Required. Default value is “QR” |

| qr_type | String | Optional. Supports “IMAGE” or “STRING” with “IMAGE” as the default. |

| order_id | String | Required. Order ID given by merchant |

| sub_merchant_id | String | Required. ID of a sub merchant. (e.g. KFCSenayanCity) |

| push_uri | String | Required. URI of merchant push-notification API (HTTP POST) |

| sellers | Seller | Optional. Detail of the seller / store. |

| items | Item | Required. The shopping items |

Seller

| Name | Type | Description |

|---|---|---|

| id | String | Optional. Detail of the seller / store Id. |

| name | String | Optional. Detail of the seller / store name. |

| url | String | Optional. Detail of the seller / store url. |

| legal_id | String | Optional. Detail of the seller / store legal Id (KTP, SIM or passport number) |

| String | Optional. Detail of the seller / store email | |

| address | Address | Optional. Detail of the seller / store residential address |

Address

| Name | Type | Description |

|---|---|---|

| first_name | String | Optional. |

| last_name | String | Optional. |

| address | String | Optional. |

| city | String | Optional. |

| postal_code | String | Optional. |

| phone | String | Optional. |

| country_code | String | Optional. ISO 3166-1 alpha-3 |

Detail QR Item

| Name | Type | Description |

|---|---|---|

| id | String | Optional. Can be product SKU. Important! for item fee such as: shipping fee, admin fee etc. you have to use this id: shippingfee, adminfee, taxfee, discount, additionalfee, insurancefee, mixpayment. |

| name | String | Required. product name given by merchant. |

| price | Double | Required. Price of the item. |

| type | String | Optional. Product category. |

| quantity | Integer | Required. Quantity of the item bought. |

| additional_info | string | Optional. Additional information about other data from partner. |

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| qr_image | String | The QR Code URL to be displayed on POS |

| transaction_id | String | Transaction ID given by Kredivo |

Confirm Transaction

In this tutorial you will learn how to confirm that you have received and created an order in your system. This confirmation is needed in response to a push notification from Kredivo, indicating that the consumer has completed the transaction. Once you have received the push notification, you should update the status of the transaction.

1. Receive notification from Kredivo

Once a consumer has completed a purchase, Kredivo will inform you via a POST request. The POST request will be made to the push notification URI you provided when you created the checkout order.

HTTP Notification example of transaction::

{

"status": "OK",

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "pending",

"order_id": "KD125262",

"message": "Transaction status is pending",

"shipping_address": {

"city": "Jakarta Selatan",

"first_name": "Darana 2",

"last_name": "Pratama",

"countrycode": "IDN",

"creation_date": "2017-08-04T18:28:14",

"phone": "0217248724",

"state": "",

"transaction": 1505866,

"postcode": "12120",

"location_details": "Jl. Kerinci IX No. 5-A"

},

"transaction_time": 1501846094,

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8",

"signature_key": "o5KZPDcxgEA9QutAVcIQwE3suQRkTEIA1VXcoHp7KaWJnpHx0uuHETBVpxfYLbaPyS8RJg34uVxTUX64cfUTzVVhCrSif%2FUg92J2WyLs%2FhQ%3D",

"sub_merchant_id": "KFCSenayanCity"

}

Response Body from Kredivo

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| shipping_address | Address | Optional. Shipping address of the customer/shopper |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

| sub_merchant_id | String | ID of a sub merchant. (e.g. KFCSenayanCity) |

Response Address Info

| Name | Type | Description |

|---|---|---|

| city | String | Optional. |

| first_name | String | Optional. |

| last_name | String | Optional. |

| countrycode | String | Optional. |

| creation_date | String | Optional. |

| phone | String | Optional. |

| state | String | Optional. |

| transaction | Integer | Optional. |

| postcode | String | Optional. |

| location_details | String | Optional. |

2. Merchant Response

merchant response should be in JSON, structured like this:

{

"status":"OK",

"message":"Message from merchant if any"

}

3. Confirm the order status

You must now get the order status to validate the notification originated from Kredivo server

Using the API:

GET /kredivo/v2/update?transaction_id=bb0380d7-2688-4e73-a668-997f3fc5cbec&signature_key=5f1fa4a524f5a8201a3a373d67b5796840bed1598b2bb816855d0e14d01cd09b988b4b861f39bed642b4db861108bbf0dd84ce8e17caf675d4bf2c81ab545397

Request Body

| Name | Type | Description |

|---|---|---|

| transaction_id | String | Transaction Id given by Kredivo |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

Response Body

Example response after call API v2/update:

{

"status": "OK",

"legal_name": "TANDRA",

"fraud_status": "accept",

"order_id": "KD125262",

"transaction_time": 1501846094,

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "settlement",

"message": "Confirmed order status. Valid!",

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8",

"sub_merchant_id": "KFCSenayanCity",

}

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR). |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| fraud_status | String | Detection result by Fraud Detection System (FDS), the values is:accept: Approved by FDS; deny: Denied by FDS. Transaction automatically failed |

| legal_name | String | legal name of kredivo account |

| sub_merchant_id | String | ID of a sub merchant. (e.g. KFCSenayanCity) |

4. Settle an order in your system

You should now settle the order in your system with the order data that you want to store if transaction_status is SETTLEMENT.

EDC Checkout

EDC Checkout is our solution for those of you have have a physical store.

We also provide a dashboard to help you monitor the transactions and perform cancellation.

Contact us to know more about our EDC solution.

Initiate EDC Checkout

Interface/API Specifications

We will put the details about endpoints, request/response format, validation etc.

Using the API:

The Request JSON structured like this:

{

"server_key": "8tLHIx8V0N6KtnSpS9Nbd6zROFFJH7",

"sub_merchant_id": "KFCSenayanCity",

"source": "EDC Mobile",

"push_uri": "https://merchant.com/pushnotif",

"order_id": "12345678912",

"amount": 15000,

"mobile_number": "+62-85210549044",

"terminal_id": "WDCMERCHANT0001"

}

Response:

{

"status": "OK",

"message": "",

"transaction_id": "bcda87e2-e87b-4b7f-add4-206bb4c1d72c",

"order_id": "12345678912"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| sub_merchant_id | String | Required. ID of a sub merchant. (e.g. KFCSenayanCity) |

| source | String | Required. Default value is “EDC Mobile” |

| push_uri | String | Required. URI of merchant push-notification API (HTTP POST) |

| order_id | String | Order Id given by merchant |

| amount | Double | Required. The transaction amount |

| mobile_number | String | User phone number |

| terminal_id | String | Optional. Outlet merchant’s EDC device identifier. |

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| transaction_id | String | Transaction ID given by Kredivo |

| order_id | String | Order Id given by merchant |

Confirm Transaction

In this tutorial you will learn how to confirm that you have received and created an order in your system. This confirmation is needed in response to a push notification from Kredivo, indicating that the consumer has completed the transaction. Once you have received the push notification, you should update the status of the transaction.

1. Receive notification from Kredivo

Once a consumer has completed a purchase, Kredivo will inform you via a POST request. The POST request will be made to the push notification URI you provided when you created the checkout order.

HTTP Notification example of transaction:

{

"status": "OK",

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "pending",

"order_id": "KD125262",

"message": "Transaction status is pending",

"shipping_address": {},

"transaction_time": 1501846094,

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8",

"signature_key": "o5KZPDcxgEA9QutAVcIQwE3suQRkTEIA1VXcoHp7KaWJnpHx0uuHETBVpxfYLbaPyS8RJg34uVxTUX64cfUTzVVhCrSif%2FUg92J2WyLs%2FhQ%3D",

"sub_merchant_id": "KFCSenayanCity"

}

Response Body from Kredivo

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| shipping_address | Address | Optional. Shipping address of the customer/shopper |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

| sub_merchant_id | String | ID of a sub merchant. (e.g. KFCSenayanCity) |

2. Merchant Response

merchant response should be in JSON, structured like this:

{

"status":"OK",

"message":"Message from merchant if any"

}

3. Confirm the order status

You must now get the order status to validate the notification originated from Kredivo server

Using the API:

GET /kredivo/v2/update?transaction_id=bb0380d7-2688-4e73-a668-997f3fc5cbec&signature_key=5f1fa4a524f5a8201a3a373d67b5796840bed1598b2bb816855d0e14d01cd09b988b4b861f39bed642b4db861108bbf0dd84ce8e17caf675d4bf2c81ab545397

Request Body

| Name | Type | Description |

|---|---|---|

| transaction_id | String | Transaction Id given by Kredivo |

| signature_key | String | Signature key to validate if the notification is originated from Kredivo. |

Response Body

Example response after call API v2/update:

{

"status": "OK",

"legal_name": "TANDRA",

"fraud_status": "accept",

"order_id": "KD125262",

"transaction_time": 1501846094,

"amount": "1500100.00",

"payment_type": "30_days",

"transaction_status": "settlement",

"message": "Confirmed order status. Valid!",

"transaction_id": "fadee4e5-99a2-48d6-952d-007f3fa508e8",

"sub_merchant_id": "KFCSenayanCity",

}

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR). |

| message | String | Description of status |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_id | String | Transaction Id given by Kredivo |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| order_id | String | Order Id given by merchant |

| amount | String | The transaction amount |

| fraud_status | String | Detection result by Fraud Detection System (FDS), the values is:accept: Approved by FDS; deny: Denied by FDS. Transaction automatically failed |

| legal_name | String | legal name of kredivo account |

| sub_merchant_id | String | ID of a sub merchant. (e.g. KFCSenayanCity) |

4. Settle an order in your system

You should now settle the order in your system with the order data that you want to store if transaction_status is SETTLEMENT.

Reversal Transaction

Interface/API Specifications

To terminate the EDC transaction in case of intermittent issue, connection or network issue.

We will put the details about endpoints, request/response format, validation etc.

Using the API:

The Request JSON structured like this:

{

"order_id": "12345678912",

"server_key": "8tLHIx8V0N6KtnSpS9Nbd6zROFFJH7"

}

Positive Response:

{

"message": "",

"status": "OK"

}

Negative Response:

{

"message": "",

"status": "ERROR"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| order_id | String | Required. Order Id given by merchant |

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| message | String | Optional. If any message |

Additional APIs

You will find other APIs here that will help you check the transaction status (in case our push notification failed), cancel the transaction, and calculate the interest and payment.

Check Transaction Status

Once your customer is done processing the transaction on their side, you will need to call check transaction status API.

Using the API:

The Request JSON structured like this:

{

"server_key":"8tLHIx8V0N6KtnSpS9Nbd6zROFFJH7",

"order_id": "KB-0c40f395"

}

Response:

{

"fraud_status": "accept",

"transaction_time": 1637743030,

"order_id": "KB-0c40f395",

"external_userid": "S9JRJ2bGiS4d",

"status": "OK",

"legal_name": "Rangge",

"message": "Transaction is settlement",

"amount": "75000.00",

"discount_amount": 0,

"transaction_id": "7401e873-ea77-455e-9f31-4ca2268304dc",

"payment_type": "30_days",

"transaction_status": "settlement"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| order_id | String | Required. Order ID given by merchant. |

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| fraud_status | String | Fraud checking result (accept or deny) |

| external_userid | String | User ID |

| legal_name | String | Legal name of user |

| order_id | String | Order ID given by merchant |

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| amount | Double | Transaction amount |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_status | String | Transaction status of the transaction |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| message | String | Detail status |

| transaction_id | String | Transaction ID given by Kredivo |

Cancel Transaction

Transaction can be cancelled with this API if transaction has been completed.

Using the API:

The Request JSON structured like this:

{

"server_key":"8tLHIx8V0N6KtnSpS9Nbd6zROFFJH7",

"transaction_id": "2be7d9ea-ccba-4743-8b92-0f1fc3ec358d",

"cancellation_amount": 5000,

"cancellation_reason":"Out of stock",

"cancelled_by":"Althea",

"cancellation_date":"1512032053",

"order_id":"KB-0123456",

"cancellation_id": "1234567"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| cancellation_id | String | Optional. 60 char. This is not the order ID. 1 order ID can have multiple cancellation ID. If no cancellation ID is sent, we will use the order ID and cancellation amount as the cancellation unique identifier. Cancellation requests with the same order ID and cancellation amount cannot be processed if the time elapsed between the two requests is less than 1 hour. |

| order_id | String | Required. Order Id given by merchant |

| transaction_id | String | Required. Transaction Id given by Kredivo |

| cancellation_amount | Integer | Optional. If you don’t pass this parameter or if you pass a cancellation amount that is equal to the transaction amount, it will be treated as a full cancellation. If the cancellation amount passed is less than the transaction amount, it will be treated as a partial cancellation. If the cancellation amount is bigger than the transaction amount or a 0 or a negative number, we will return an error. |

| cancellation_reason | String | Required. A description that clarifies reason of cancelling the transaction |

| cancelled_by | String | Required. Cancellation requester name/ id |

| cancellation_date | UNIX timestamp (epoch) | Required. Timestamp of Cancellation |

Response for full cancellation:

{

"status": "OK",

"fraud_status": "accept",

"order_id": "EDCA0020F1E-FE69-43EA-B9CA-FCDE1B52B2A6",

"transaction_time": 1513146999,

"amount": "5000000.00",

"payment_type": "30_days",

"transaction_status": "cancel",

"message": {short, long}"Cancelled the transaction!",

"transaction_id": "2be7d9ea-ccba-4743-8b92-0f1fc3ec358d",

"sub_merchant_id": "KFCSenayanCity",

"outlet_id": "KFCSCT01"

}

Response for full/partial cancellation:

{

"status": "OK",

"fraud_status": "accept",

"order_id": "EDCA0020F1E-FE69-43EA-B9CA-FCDE1B52B2A6",

"transaction_time": 1513146999,

"amount": "1000.00",

"payment_type": "30_days",

"transaction_status": "settlement",

"message": "Succes cancelling transaction by amount",

"transaction_id": "2be7d9ea-ccba-4743-8b92-0f1fc3ec358d",

"sub_merchant_id": "KFCSenayanCity",

"outlet_id": "KFCSCT01"

}

Example for full/partial cancellation negative response:

{

"status": "ERROR",

"error": {

"code": 2415,

"message": "Cancellation amount bigger than remaining transaction amount that can be cancelled",

"kind": "deprecated"

}

}

{

"status": "ERROR",

"error": {

"code": 1009,

"message": "Transaksi sudah dibatalkan.",

"kind": "deprecated"

}

}

{

"status": "ERROR",

"error": {

"code": 2415,

"message": "This cancellation_id is already PROCESSED.",

"kind": "deprecated"

}

}

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR). |

| fraud_status | String | Detection result by Fraud Detection System (FDS), the values is:accept: Approved by FDS deny: Denied by FDS. |

| order_id | String | Order Id given by merchant |

| transaction_time | UNIX timestamp (epoch) | Timestamp of transaction |

| amount | String | The transaction amount |

| payment_type | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| transaction_status | String | Transaction status of a transaction, the values is: |

| settlement: Transaction is successful | ||

| pending: User has not completed the transaction | ||

| deny: Transaction has been denied by Kredivo | ||

| cancel: Transaction has been cancelled by merchant | ||

| expire: User did not complete transaction, thus transaction is expired | ||

| message | String | Description of status |

| transaction_id | String | Transaction Id given by Kredivo |

| sub_merchant_id | String | ID of a sub merchant. For Offline Merchant Only (e.g. KFCSenayanCity) |

| outlet_id | String | ID of the EDC terminal ID used during transaction checkout |

Kredivo Loan Calculator

This API will give you the breakdown of the monthly payment of Kredivo installment.

Using the API:

The Request JSON structured like this:

{

"server_key":"8tLHIx8V0N6KtnSpS9Nbd6zROFFJH7",

"user_token":"XXX-XXX",

"amount":2400000,

"items": [

{

"id":"BB12345678",

"name":"iPhone 5S",

"price":2400000,

"url":"http://merchant.com/cellphones/iphone5s_64g",

"type":"Smartphone",

"quantity":1

}

]

}

Example Response:

{

"payments": [

{

"raw_amount": 2424000.0,

"amount": 2424000,

"discount_interest_rate": null,

"raw_monthly_installment": 2423999.801457357,

"id": "30_days",

"tenure": 1,

"service_fee": 24000,

"mdr": null,

"name": "Bayar dalam 30 hari",

"interest_rate": "0",

"rate": 0.0,

"service_fee_percentage": 1.0,

"monthly_installment": 2424000,

"installment_amount": 2424000

},

{

"raw_amount": 2472000.0,

"potential_cashback": {

"monthly_cashback": 9888,

"total_cashback": 29664

},

"amount": 2472000,

"discount_interest_rate": null,

"raw_monthly_installment": 823999.93388194,

"id": "3_months",

"tenure": 3,

"service_fee": 72000,

"mdr": null,

"name": "Cicilan 3 bulan",

"interest_rate": "0",

"rate": 0.0,

"service_fee_percentage": 3.0,

"monthly_installment": 824000,

"installment_amount": 2472000

},

{

"raw_amount": 2400000.0,

"potential_cashback": {

"monthly_cashback": 4800,

"total_cashback": 28800

},

"amount": 2400000,

"discount_interest_rate": null,

"raw_monthly_installment": 462397.09959627397,

"id": "6_months",

"tenure": 6,

"service_fee": null,

"mdr": null,

"name": "Cicilan 6 bulan",

"interest_rate": "2,6",

"rate": 2.6,

"service_fee_percentage": 0,

"monthly_installment": 462400,

"installment_amount": 2774400

},

{

"raw_amount": 2400000.0,

"potential_cashback": {

"monthly_cashback": 2400,

"total_cashback": 28800

},

"amount": 2400000,

"discount_interest_rate": null,

"raw_monthly_installment": 329064.15,

"id": "9_months",

"tenure": 9,

"service_fee": null,

"mdr": null,

"name": "Cicilan 9 bulan",

"interest_rate": "2,6",

"rate": 2.6,

"service_fee_percentage": 0,

"monthly_installment": 329070,

"installment_amount": 2961630

},

{

"raw_amount": 2400000.0,

"potential_cashback": {

"monthly_cashback": 2400,

"total_cashback": 28800

},

"amount": 2400000,

"discount_interest_rate": null,

"raw_monthly_installment": 262396.4704067336,

"id": "12_months",

"tenure": 12,

"service_fee": null,

"mdr": null,

"name": "Cicilan 12 bulan",

"interest_rate": "2,6",

"rate": 2.6,

"service_fee_percentage": 0,

"monthly_installment": 262400,

"installment_amount": 3148800

},

{

"raw_amount": 2400000.0,

"potential_cashback": {

"monthly_cashback": 2400,

"total_cashback": 28800

},

"amount": 2400000,

"discount_interest_rate": null,

"raw_monthly_installment": 195733.65,

"id": "18_months",

"tenure": 18,

"service_fee": null,

"mdr": null,

"name": "Cicilan 18 bulan",

"interest_rate": "2,6",

"rate": 2.6,

"service_fee_percentage": 0,

"monthly_installment": 195740,

"installment_amount": 3523320

},

{

"raw_amount": 2400000.0,

"potential_cashback": {

"monthly_cashback": 2400,

"total_cashback": 28800

},

"amount": 2400000,

"discount_interest_rate": null,

"raw_monthly_installment": 162402.98,

"id": "24_months",

"tenure": 24,

"service_fee": null,

"mdr": null,

"name": "Cicilan 24 bulan",

"interest_rate": "2,6",

"rate": 2.6,

"service_fee_percentage": 0,

"monthly_installment": 162410,

"installment_amount": 3897840

}

],

"message": "Available payment types are listed.",

"status": "OK"

}

Request Body

| Name | Type | Description |

|---|---|---|

| server_key | String | Required. Each merchant will have server_key generated by Kredivo. |

| user_token | String | Optional. This user_token will authenticate the user’s limit for 0-click transactions once it’s been set. |

| amount | Integer | Required. The transaction amount |

| items | Item | Required. The shopping items |

Response

| Name | Type | Description |

|---|---|---|

| status | String | Status code (OK or ERROR) |

| payments | Payment | List of available payment type to the transaction including its breakdown. You can find available payment type here. |

Product Item

| Name | Type | Description |

|---|---|---|

| id | String | Required. Can be product SKU. Important! for item fee such as: shipping fee, admin fee etc. you have to use this id: shippingfee, adminfee, taxfee, discount, additionalfee, insurancefee, mixpayment. |

| name | String | Required. Product name |

| price | double | Required. Price of the item in the quantity |

| url | String | Required. URL to the product item on merchant site |

| image_url | String | Optional. URL to the product item image |

| type | String | Required. Product category |

| quantity | Integer | Required. Quantity of the item bought |

Payment Type

| Name | Type | Description |

|---|---|---|

| id | String | Payment id/type chosen by the shopper (30_days, 3_months, 6_months, 9_months, 12_months, 18_months, 24_months) |

| name | String | Payment type name |

| tenure | Integer | Tenure |

| rate | float | Interest rate |

| interest_rate | String | Interest rate in string |

| interest_amount | Double | Interest amount |

| discount_interest_rate | float | Special interest rate |

| amount | Double | Transaction amount. Total purchased items. |

| raw_amount | Double | Transaction amount before rounding |

| monthly_installment | Double | Installment per month |

| raw_monthly_installment | Double | Installment per month before rounding |

| installment_amount | Double | Total installment |

| service_fee_percentage | float | Kredivo service fee percentage |

| service_fee | Double | Kredivo service fee |

| mdr | Double | MDR passed to user |

| potential_cashback | Potential Cashback | Potential cashback |

Potential Cashback

| Name | Type | Description |

|---|---|---|

| monthly_cashback | Double | Monthly cashback |

| total_cashback | Double | Total cashback |

Plugins

We provide plugins for e-commerce site running on certain platforms to make it easier to integrate with Kredivo. Below are plugins for some supported platforms.

Woocommerce

Download plugin for woocomerce v.3.x.x here

Prestashop

Download plugin for prestashop v.1.6.x here

Opencart

Download plugin for opencart v.1.x.x here and opencart v.2.x.x here

Magento

Download plugin for magento v.1.x.x here and magento v.2.x.x here

Branding & Visual

Logos

Using Kredivo’s logotype generates trust and increases your conversion.

Your website’s background

Depending on if you have dark or light background you can get either a blue or white logo.

Width

We recommend that the Kredivo logo displayed at your site is between 100-300 px. Note that you should not add px after the size parameter.

Example:

Download Kredivo logo here.

How to use the Kredivo logo

On your frontpage

When showing the different payment alternatives you offer in your store, display our one and only logo. When hovering over the logo shows details on the payment methods available in your store.

On product level

You will increase the conversion for high value products by showing your consumers that they have the ability to pay in installments. Always use our logotype on product level. The logotype is highly recognisable, even in small sizes. For optimal conversion use our payment method widget.

Marketing Resource

What is Merchant Success?

Kredivo team is here to work together with you to identify and solve problems, support and build a long-term mutual relationship, as well as create collaborative campaigns to increase your revenue.

Our product is your “Sales Enabler”, meaning that Kredivo helps your customer to buy more and more often. In order to see significant results of our product, we strongly encourage you to implement merchant best practice

Why is this important to implement Merchant Best Practices?

Incremental sales takes time and effort. Acquiring customer that is loyal require time and effort. Kredivo is here to facilitate the process through Merchant Best Practice.

Education is crucial. Instant credit financing is not a familiar concept with many consumers. It is important for merchant to educate and create a good consumer flow within the platform.

Sales enabler engine. “Buy now pay later” and “Installment without credit card” is a very strong message for consumptive consumers, allowing them to buy more and more often. Sharing this messages within the platform clearly will help increase sales.

Important Information:

- Please send all Kredivo related collateral (newsletter, product promotion, social media posting, banner, FAQ) to successops@finaccel.co prior to posting for approval.

- For any merchant related inquiries on customer service and payment information please send it to merchant.help@kredivo.com. (Note: this is for merchant related inquiries not consumers related inquiries, in any circumstances this email shall not be given to consumers).